Masters of Monetisation

An Elite Strike Force of Asset Extraordinaires

Breaching The Sacred Vault

Demands of the Dominion

To embark on this epic funding journey, we demand proof of your asset’s lineage and worth. Prepare to unveil:

The Investor’s Codex (CIS):

A detailed chronicle of your identity and venture.

Corporate Birthright (Certificate of Incorporation):

Proof of your entity’s legal existence.

Solemn Oath (Statement Non-Solicitation of Funds):

A declaration of your commitment to this exclusive alliance.

Passport to Fortune (Clear copy of Investor Passport):

A pristine copy of your global access permit.

Financial Authority Grant (ATV):

A mandate for us to delve into the depths of your treasury.

Treasury Blueprint (Bank Statement Proof of Assets):

A clear map of your financial dominion.

Bank’s Sacred Seal (BCL Signed By 2 Officers):

Twin signatures of banking nobility, adorned with their secret codes.

Guardians’ Identity (Bank Officer business cards):

Tokens bearing the insignia of your bank’s high council.

*Specific Requirements Per Asset Class Apply

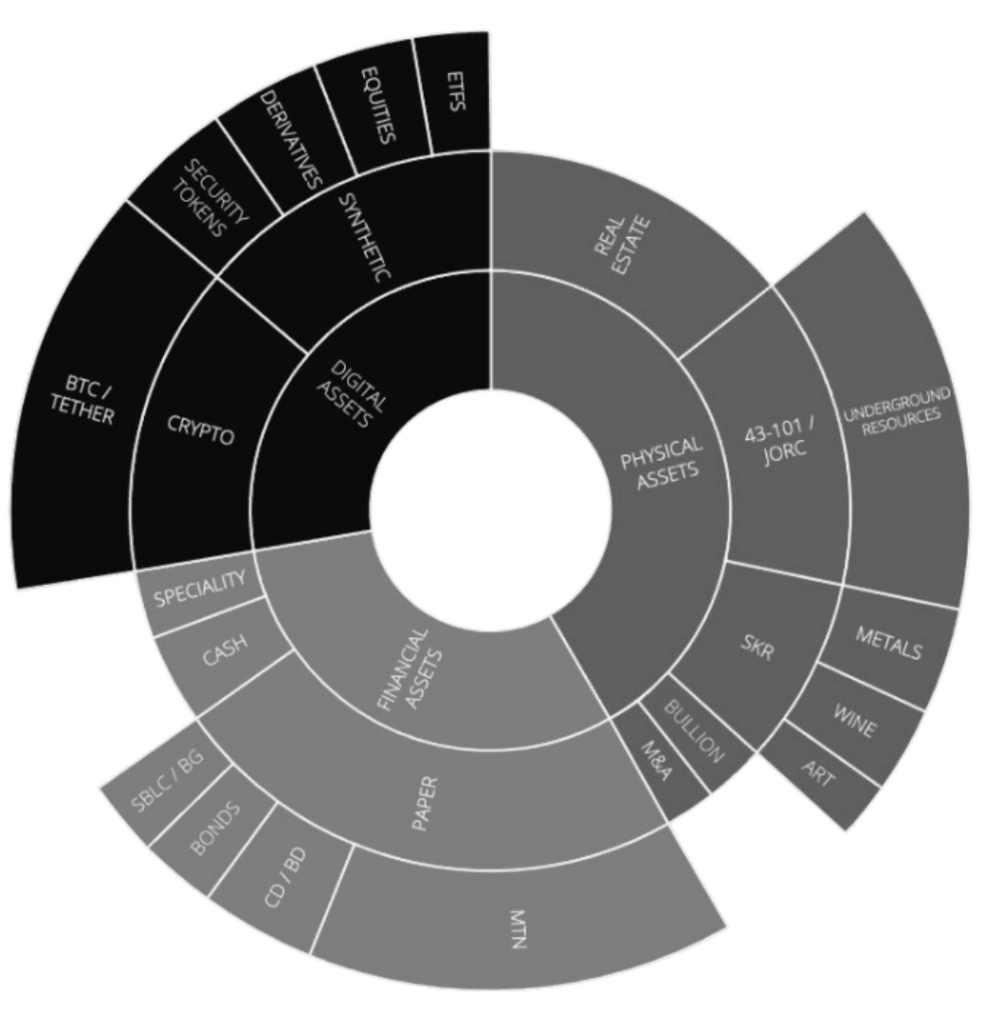

Asset Armory

CLASS 1 REQUIREMENTS

CLASS 2 REQUIREMENTS

CLASS 3 REQUIREMENTS

CLASS 4 REQUIREMENTS

CLASS 5 REQUIREMENTS

CLASS 6 REQUIREMENTS

CLASS 7 REQUIREMENTS

CLASS 8 REQUIREMENTS

CLASS 9 REQUIREMENTS

CLASS 10 REQUIREMENTS

Shadowplay of Solvency:

The Art of Credit Enhancement

In the labyrinthine world of corporate finance, where shadows dance and illusions deceive, there exists a secret weapon: credit enhancement. A company seemingly destined for financial precipice, seeks to bolster its balance sheet, to paint a more prosperous picture for potential lenders. This is not merely a cosmetic touch-up; it’s a strategic gambit, a calculated risk to improve its creditworthiness.

Imagine a corporate fortress, its walls battered by the relentless tides of debt. Credit enhancement offers a lifeline, a way to reinforce the structure, to make it more impervious to the storms that may arise. By enhancing its solvency ratios, a company can reduce its measured credit risk, akin to fortifying the castle gates with impenetrable steel. This, in turn, attracts more favourable terms from lenders, lowering interest rates and easing the financial burden.

But how does this sleight of hand work? Picture a clandestine exchange, a transaction bound by a pact. The company, in need of a financial boost, enters into a partnership with a heroic figure, a “nominee company” (which henceforth shall be known as “NomCom”). This NomCom, in exchange for a stake in the company, provides a powerful weapon: a “Standby Letter of Credit (“SBLC”).

This SBLC is a financial instrument, a promise of payment that acts as a shield, protecting the company from financial harm. It’s like a hidden guardian, lurking in the shadows, ready to spring into action if the company falters. The SBLC is recognised as a debt on the company’s balance sheet, but it’s a debt with a unique twist. It’s a debt that can be offset by the shares held by the mighty NomCom.

However, this daring manoeuvre is not without its risks. The NomCom, in issuing the SBLC, may require additional security. This could involve personal guarantees from the company’s directors or a pledge of assets. The SBLC issuing institution may also demand a share of the company’s equity as collateral.

It’s a delicate balancing act, a game of shadows and light. The company must weigh the benefits of improved creditworthiness against the potential risks and costs associated with credit enhancement. But for those willing to take the gamble, the rewards can be substantial, offering a lifeline in a world where financial survival often hinges on the tiniest of margins.

The most intriguing element of credit enhancement is the SBLC. It’s like a magic spell that conjures up cash out of thin air. A bank essentially guarantees to pay off a company’s debts if it defaults. It’s a powerful tool, but it comes at a price.

So, the next time you hear about a company’s credit rating improving, remember it might not be as magical as it seems. It could just be a well-executed illusion, a carefully orchestrated dance in the depths of corporate finance.

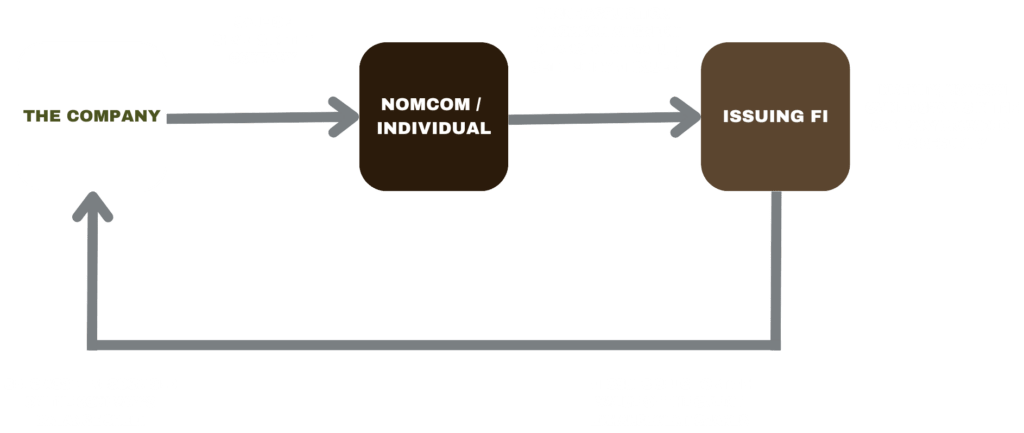

STRUCTURING

The process involves Trade and Merchant Trust facilitating the release of a letter of credit to the Company for the purpose of enhancing its balance sheet. This is done as follows:

1) The Client sells an agreed percentage stake in “the Company” to a Nominee Company (“NomCom”), or Individual, who is effectively the Applicant in the SBLC transaction. The Company’s current valuation is taken into account.

2) NomCom subscribes for the agreed percentage of the shares in the Company via a share subscription agreement at a per share amount supported by the current company valuation.

3) The Company reserves the right to buy back the shares at the same value at the end of the SBLC tenure.

4) NomCom pays for this subscription by way of issuing an SBLC, from a Financial Institution to the Company for the total amount of agreed “Credit Enhancement”.

5) The Company recognises the debtor on its balance sheet as the Credit Enhancement value, supported by the SBLC.

6) The Company balance sheet is audited, and the transaction is validated by an independent auditor.

7) At the end of the facilitation period the buy-back transaction is executed and the transaction unwound.

Masters of Market Dominance: Physical Asset Specialists

Treacherous Waters

In the shadowy realm where the tangible meet the ethereal world of finance, a battle rages. A battle for control, for value, for dominion. This is the battlefield of Physical Asset Monetization. A nuanced and complex field, often misunderstood by many. A treacherous terrain littered with the bones of those who dared to tread without a map, a guide, or a sword forged in the fires of experience.

Here, myths and realities collide. A space rife with misconceptions and exaggerated claims, primarily due to the influx of inexperienced players who misrepresent what can realistically be achieved in financial markets with physical assets. Misguided inexperienced knights charge into the fray, their shields painted with promises of instant riches. Successfully leveraging these assets requires more than just ownership; it demands a deep understanding and knowledge of the financial ecosystem, compliance regulations, and the intricate processes involved.

The fortress of entry extends beyond the heavens, and the path to success is fraught with challenges, including a frightening rate of failure. Regulations are the dragons guarding this treasure hoard, their fiery breath scorching those who underestimate their power. Inadequate asset packaging and inability to meet stringent compliance standards imposed by financial institutions (and regulatory bodies) means you’ll be meeting your maker! True wealth lies not in hasty gains, but in the mastery of a complex ecosystem.

A Legacy of Success

We are not mere adventurers in this realm. We are seasoned warlords, our lineage etched into the history of financial conquest. Our arsenal? Hundreds of years of combined experience, we bring a wealth of knowledge and an impeccable track record of success in the crucible of the highest stakes deals in financial markets. We’ve tamed beasts of high-value physical assets, from real estate and commodities to rare collectibles. We have cultivated strong relationships with the top 10 global insurers, enabling us to identify and implement bespoke insurance policies that align with the unique requirements of direct financial market operations. Our alliance with the mightiest insurance titans ensures our dominion is unchallenged.

Monetisation is more than plunder; it’s a strategic siege – not just about securing funds; it’s about doing so in a manner that is compliant with the highest standards of due diligence and financial regulation. We craft intricate war machines – financial instruments – designed to breach the walls of scepticism and compliance – structures that can withstand the scrutiny of regulators and financial institutions alike. Our engineers, masters of asset packaging, transform ordinary objects into formidable weapons of wealth.

Rigorous Compliance and Strategic FORMATIONS

One of the most critical aspects of successful asset monetisation is the meticulous packaging of assets. This process involves not just the physical presentation of the asset but also its alignment with financial market requirements and regulatory expectations. Only the elite, the cunning, and the cooperative join our crusade. Our team excels in this domain, ensuring that every asset we work with is presented in a manner that maximises its value while meeting all necessary compliance criteria.

The process of engaging in asset monetisation is not open to all. Entry to this realm is forbidden to the unprepared. We are the gatekeepers, our standards as unforgiving as the mountain peaks. We maintain a rigorous selection process, scrutinising potential clients to ensure that their level of cooperation, sophistication, and commercial acumen aligns with the stringent demands of the financial markets. Only those meeting our exacting standards are invited to participate in our private funding programs.

Tailored Strategies for Long-Term CONQUERING

We understand that each client’s needs and objectives are unique. Therefore, our approach to asset monetisation is highly customised, designed to align with the larger project goals and timelines. Whether it’s a short- term capital requirement or a long- term strategic deployment, we provide continued support throughout the project’s lifecycle.

In select cases, we offer extended engagements, fostering long-term partnerships that are beneficial for all parties involved. Our commitment to our clients is unwavering; we are dedicated to not only achieving but exceeding their financial goals through the intelligent and strategic monetisation of their physical assets.

A Privilege, Not a Right

It’s important to recognise that participation in our programs is a privilege, not a right. We operate in a space where the margin for error is minimal, and the potential for success is vast, but only for those who are prepared to meet the rigorous demands of the process. Our role is to guide you through this complex landscape, leveraging our expertise and industry connections to unlock the full potential of your physical assets.

Remember, this is no playground for the faint of heart, it’s a jungle. Failure is a chasm, success a mountaintop reserved for the truly exceptional. We offer not just a path, but a dominion. Will you seize the opportunity or be left to watch from below?

Position Yourself For VICTORY

The monetisation of physical assets is a sophisticated and demanding endeavour that requires a unique blend of experience, expertise, and strategic acumen. With our team of specialists, our campaigns are tailored, each battle plan unique. Whether a swift raid for immediate resources or a protracted siege for lasting dominion, we provide unwavering support. Some join us for a single conquest, others for a lifetime alliance. But all who embark on this journey with us discover a world of unimaginable riches. This journey is one of partnership, precision, and potential.

This is no mere transaction. It is a strategic alliance, a quest for extraordinary returns. We offer more than monetization; we provide a legacy. Join us, and witness the metamorphosis of your assets into a force that will reshape your world.